Every day that we currently go to the gas pumps to fill up we all are happy to see the relatively (best in over five years) gas prices we are experiencing in Canada. The reasons given for the massive drop in prices usually hinge on the low oil prices which are currently the norm in world markets.

Unfortunately for Canada a large part of our international trade is in oil price sensitive commodities and the local savings associated with lower transportation costs due to low gas prices is not enough to offset the impact on the Canadian dollar which low oil prices create.

Canadian dollar compared to other currencies

The Canadian dollar has dropped steadily against the US dollar as oil prices have plummeted with current rates starting to approach some of the lows found in early 2009. When compared to the Euro the Canadian dollar is about the middle of the range it has traded over the past five years. This is somewhat good news if you are buying European goods or traveling to Europe. The Euro is also trading very low against the US dollar so that compounds issues. When compared to the Chinese Yuan, however the story is not good however. The Canadian dollar is at the lowest it has been compared to the Yuan over the past five years, well below its average for the period and way off the high. The implications of this are going to be felt in coming months. Finally, when compared to the Yen the Canadian dollar is high. The December close is actually the highest against the Yen in the period compared.

Data is taken from a summary of rates comparisons from a Bank of Canada Exchange Lookup.

Implications

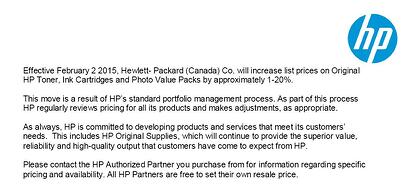

We have recently noted that our distributors and other suppliers have started to announce price increases. The reasons given will range but as shown in the image at times they could be very significant, (up to 20%). Since many of the products sold as office technology products are now manufactured in China the impact of the Yuan differential is probably as significant as the US dollar. Interestingly, even though many of the suppliers of office technology hardware are Japanese based the stronger position against the Yen does not necessarily mitigate the overall picture. Since much of their manufacturing is done in China the impact of the Chinese currency is also reflected in their pricing.

What does this mean for you?

Essentially, it means that if you are looking at an IT or office technology investment in the near term it might be advisable to lock it in now before the price increases flow throughout the whole sector. Notices as coming at this point but usually with a few weeks notice of the impending increases. Ask your vendor if they are aware of new pricing coming and consider your options to buy now. Your vendor is not going to be able to offset the kinds of increases that are being talked about. As noted above they could range up to 20% or more depending upon what it is that is being bought.

Since oil pricing has such a major impact on the value of the Canadian dollar we are unlikely to see a rally in the dollar in the near future, unless we see a significant increase in oil. A present I don't see many predicting a quick turn around in oil pricing so we can be fairly certain that pricing adjustments based upon currency will be coming. Of course the lower transportation costs will help offset a bit of the impact but not enough so we will not feel the new pricing. It may be time to look for other ways to lower your operating costs through process changes to help offset the potential increases.

Lee K